In the world of crowdfunding, finding a reliable platform where you can secure a decent return on your investments is akin to finding a needle in a haystack. It’s challenging, but not impossible. Enter Kickfurther – an innovative crowdfunding platform that promises a unique way for ordinary individuals to earn money by investing in inventory. But is it legitimate or just another elaborate scam? This comprehensive review takes a deep dive into all aspects of Kickfurther, from its business model and earning potential to user experience and credibility. Brace yourself for an eye-opening journey through one of the most talked-about platforms in the crowdfunding industry today!

Kickfurther has received mixed reviews from users. While some users have had positive experiences with the platform, citing good rates, a vetting process, and good communication, there are also negative reviews cautioning against investing due to issues with failed companies not repaying lenders and a lack of action from Kickfurther. It is advisable to exercise caution and conduct thorough research before using Kickfurther for inventory financing.

Kickfurther is a unique crowdfunding platform that enables everyday investors to finance inventory for small businesses in exchange for a portion of their future profits. The business model centers around an innovative technique called consignment funding, where investors provide cash upfront to help brands buy inventory, which the latter then sells to customers. A percentage of the profits from product sales returns to the investor while the rest goes to the merchant.

For instance, let’s say you invest $1,000 in a clothing brand’s inventory. Suppose they sell $5,000 worth of clothes that season, generating a profit of $1,000. In that case, the merchant pays back a set rate (say 20%) on that profit ($200) to you as an investor while keeping the remaining sum ($800).

This system offers an alternative approach to other types of crowdfunding that emphasize donations or equity shares. It allows investors and merchants to work collaboratively towards mutual success.

Now that we understand Kickfurther’s innovative approach, let’s explore how the investment process works step-by-step.

The first step in investing with Kickfurther is setting up an account and pledging funds to support your preferred brand. The minimum investment amount starts at $20 with no cap limit – investors have full discretion over how much they choose to invest.

Once you’ve selected a brand, it’s time to evaluate their deal offer. Brands pitch their campaigns and specify how much they require in inventory financing as well as what their target revenue projections are for a particular season or product line. This information is presented on a dashboard accessible by investors, allowing them a clear overview of potential risks and returns.

After reviewing and vetting brands you’re interested in working with, it’s time to get started by pledging funds towards helping these companies acquire inventory.

During this process, you may be invited to join Co-Op Voting sessions where investors typically vote on participant proposals. This can include adjusting the terms of a deal or extending the purchase order deadline if needed. Such cooperation helps with transparency and provides an engaged community that works towards mutual benefit.

Suppose the brand hits its target sales figures, which are usually determined through (net sales). In that case, profits are calculated and disbursed back to investors at a pre-agreed rate. The funds are credited to your Kickfurther account, where you have the option of either reinvesting in another campaign, withdrawing money to your bank account, or keeping it for future investment opportunities.

Kickfurther is a unique crowdfunding platform that offers investors an opportunity to invest in a wide range of businesses. This platform caters to small and medium-sized brands with cash flow problems, primarily in the retail sector. Whether you’re interested in fashion, pet products, food, or household items, Kickfurther has something for everyone. Investors can browse through their marketplace and select which company they would like to invest in based on their investment goals, interests, and the information available on the platform.

For example, if you are interested in fashion or apparel companies, Kickfurther’s recent offerings include TOMBOLO Clothing Company, Tres Nomad LLC, and AVI-8 USA Inc., to name only a few.

See Related: How to Ask for Money: Effective Reasons and Strategies for Fundraising

Investing with Kickfurther can be beneficial in several ways.

Firstly, Kickfurther provides a unique opportunity for investors to fund inventory purchase orders for small to medium-sized brands while earning a profit. Unlike conventional investing opportunities where funds can be tied up for long periods with little returns, invested funds on Kickfurther are returned quickly upon successful completion of a co-op (typically 6-9 months). This means you can re-invest your earnings into another co-op investment opportunity.

Secondly, co-ops undergo a vetting process before being listed on the platform; this reduces the risk of fraud and increases investor confidence. Furthermore, completed co-ops have been known to earn investors up to 10% returns per investment cycle.

Think of it as providing working capital for small businesses without owning equity.

Finally, Kickfurther’s platform offers excellent transparency regarding financial data-driven reports from businesses seeking funding. Plus, they offer excellent support via their sales managers who are involved in all aspects of the funding process and are always willing to help answer questions should they arise.

That said, before jumping in and making sizable investments on the platform, it’s crucial to evaluate some potential downsides or risks that come with investing in any crowdfunding platform.

Investing with Kickfurther comes with inherent risks and potential rewards that should be analyzed before making a decision. Some of the major risks involved in investing with Kickfurther include co-op voting discrepancies, failed companies not repaying investors, and no guarantee of profits even if funded cooperatives succeed. However, there are also significant potential rewards such as high returns on investment and a streamlined process for inventory financing. One way to mitigate risks is by conducting due diligence and research into each cooperative before committing funds.

Understanding other users’ experiences is crucial when evaluating any crowdfunding platform’s legitimacy, including Kickfurther. Mixed trends have been observed regarding user experiences on this platform. Positive reviews highlight its exceptional rates, a vetting process for brands and backers, good communication from customer support representatives, and ease of use. Reviewers also mention positive experiences covering inventory costs, receiving support from the sales manager, and similar benefits.

On the other hand, negative reviews caution against investing with Kickfurther based on issues such as failed companies not repaying investors and lack of action from the company’s management to address these concerns. The communal voting system may not always represent investor sentiment accurately; reviewers warn that it is up to investors to recover their funds independently when companies fail to pay.

One Reddit user shared their experience in setting up a kick-further investment portfolio using web applications in beta-testing mode. They mention having ideals for co-investing while proposing an analysis app that reduces risk for investors on the Kickfurther platform but clarify that some users do experience great success with this crowdfunding method.

Finally, the overall customer review ratings for Kickfurther on TrustPilot are five-star level – 67%, four-star level – 4%, three-star level – 4%, two-star level – 3%, and one-star level – 22%. These numbers show a mixture of both positive and negative experiences shared by customers.

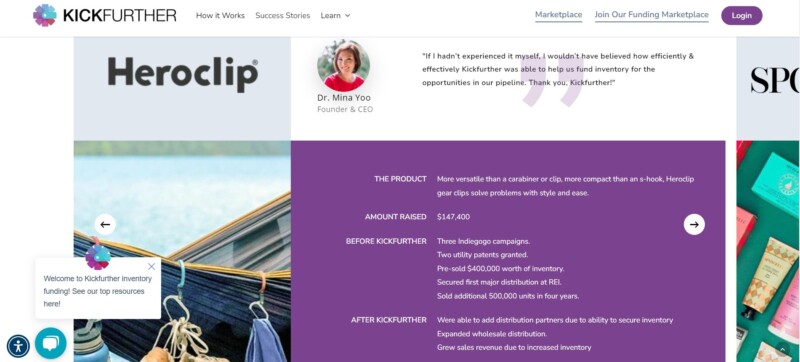

Kickfurther is a crowdfunding platform designed to help small to medium-sized businesses finance inventory. With a BBB rating of A+ and 4.6/5 stars on Trustpilot, it’s clear that many users have had positive experiences with the platform.

Users have praised Kickfurther for offering great rates, a vetting process for both brands and backers and excellent communication throughout the investment process. Many entrepreneurs have shared their success stories of being able to cover inventory costs, receive support from the sales manager, and finding the platform easy to work with.

In addition, Kickfurther offers a unique feature called “co-op voting,” which allows lenders to vote on whether they believe a particular SKU (stockkeeping unit) offering has potential. This feature provides an opportunity for investors to provide feedback regarding the product’s viability in the marketplace before they choose to invest.

However, like any investment opportunity, there are also drawbacks and risks associated with using Kickfurther. Several investors have cautioned others against investing in Kickfurther due to issues with failed companies not repaying lenders as well as an alleged lack of action from Kickfurther.

According to some negative reviews on Trustpilot, co-op voting may not be an accurate representation of investor sentiment. One reviewer mentioned that co-op voting is often dominated by a small group of investors who control most of the votes and can influence the outcome of whether or not an SKU is approved for funding.

Additionally, several users have reported losing money due to failed cooperatives that were unable to repay loans. Some reviewers have shared their personal experiences and advised caution when investing with Kickfurther.

It’s important for potential investors in any crowdfunding platform, including Kickfurther, to conduct their due diligence before making any financial commitments. Reading reviews from multiple sources online can help identify potential risks and benefits. It’s also important to weigh the potential financial return against the risk of losing money in a failed cooperative.

Now that we’ve explored both positive and negative reviews of using Kickfurther let’s see what independent analysis has to say about the platform’s legitimacy.

See Related: These Are Untapped Niche Markets to Reach a New Audience

The question of whether Kickfurther is legitimate or a scam arises from the fact that the platform operates differently from traditional crowdfunding sites. It’s understandable to approach this with skepticism, given the numerous scams that have been reported in recent times.

However, an independent analysis reveals that Kickfurther operates within legal boundaries and offers a viable financing option for businesses looking to grow. For starters, the platform has been operational since 2014 and financed over $70 million worth of inventory purchases. In addition, they have implemented various measures to ensure trust between all parties involved. For example, they have partnered with independent logistics companies to prevent any product loss or damage during shipment.

According to their website, Kickfurther boasts a success rate of 92-99.5%. This means that most co-op offerings reach their funding goals and deliver returns to backers. Another interesting feature of Kickfurther is their co-owner model (how investors are referred to on the platform). Instead of earning equity in a business, investors own a portion of the inventory being offered for sale on consignment.

To give you an idea of how the co-owner model works consider the following example: A brand’s inventory consists of 10,000 units which they wish to finance through Kickfurther’s community of co-owners by offering 1,000 packs at $50 each. An investor who purchases one pack would own a percentage share of that product line equal to $50/($50 x 1,000 packs) = 0.1%, which means they would get 0.1% of profits from the sales generated by that product line.

While this model does carry risks since it’s not insured by FDIC or other governmental protection programs often associated with investment securities, there are signs that it can be profitable. Despite this lack of coverage investors are typically lured in by the high potential returns. Some co-ops on Kickfurther have a projected profit margin of up to 20%, and while there is some risk, there is also substantial upside opportunity.

It’s important to remember that not all investments are guaranteed, just like playing the stock market you may gain or lose your investment. The nature of investing dictates volatilities, which means profits and losses, but with accurate research, cautious investing, and measured risks that will pay off the majority of this time.

All in all, Kickfurther appears to be a legitimate platform providing a unique financing option for businesses through their co-op model. They have built-in measures to ensure the safety and security of transactions – although they’re not without some risks. Investors should always conduct thorough research before investing funds in any opportunity, whether via crowdfunding or otherwise. Ultimately though it seems that with some level-headed decisions and reasonable assumptions made Kickfurther is a viable platform giving investors access to higher rewards with an imperfect understanding of reward versus risk tradeoffs.

Related Resources:

Last updated: April 26, 2024